The capitalization rate is useful for any investor when he has an option to choose between two different investment opportunities. The capitalization rate is a very reliable metric that can be used for making better Real Estate investment decisions. Once an investment completes its maximum tenure, this will play an essential role in deciding whether to withhold the investment or let it go. For instance, consider cities like Chennai, Hyderabad, or Delhi where the Real Estate is developing at a fast pace, here the cap rates range between 6-8 %. Investments in these cities are considered to be a relatively low risk than other cities. The Net Operating Income is calculated after deducting all the operating expenses and these incudes the amount due on keeping up with the facilities of properties and the property tax that is due on it.

This term is used in relation to debts or loans but can also be used in the process of lowering the value of intangible assets over a period of time much like depreciation. Price per unit is usually a term used for apartments and can be calculated by dividing the property’s price by the number of units If you X rupees of apartment and Y units, then the price per unit will be X/Y. The debt Coverage Ratio is the amount of cash flow available to meet annual interest and principal payments on debt.

The capitalization rate is calculated by dividing the property’s net operating income by the asset’s current market value. The cap rate is the rate of the total profit that a property is expected to make based on the income it generates. For Real Estate investors, this is a very crucial metric to check for, as it helps the investor to check the viability and quality of the investment. It is a simple, easy to calculate, and effective metric that helps investors to make better decisions.

What is a good capitalization rate for real estate?

By operating expenses, we mean property maintenance, taxes and other payables in a year. The capitalization rate is the best way to indicate how investment-worthy any real estate asset actually is. When sellers are looking to sell their property, they use this metric to obtain their property’s current market value.

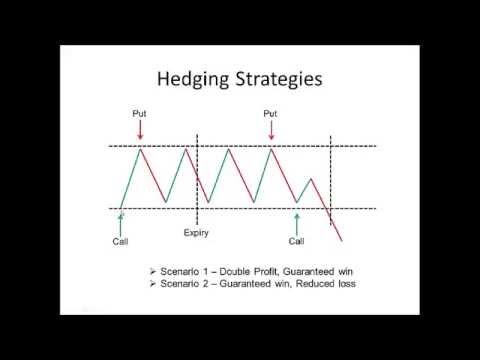

Instead, in return for keeping its money locked up for six years, the university has been guaranteed an annual return of at least 11.25%. If BREIT doesn’t hit this hurdle, Blackstone will make up the difference to a certain limit. Here’s a rundown of the most important words, terminology, and morsels of knowledge to be aware of if you’re involved with commercial real estate finance what is cap rate in real estate in any manner. However, the cap fee can also be used when you already own the property and before you put the property available on the market to promote it. While cap charges are helpful for fast back of the envelope calculations, it is important to observe when cap charges should not be used. It is calculated as the ratio of net profit over the total costs of investments.

What does cap rate tell you?

The cap rate formula

Calculated by dividing a property's net operating income by its asset value, the cap rate is an assessment of the yield of a property over one year.

Calculating this metric is quite simple, and anyone can do it using the simple formula. NOI is always determined before mortgage payments, depreciation, amortization, or capital expenditures are taken into account. India becomes a preferred destination for investment due to continued easing in FDI regulation in various industries, favourable capital market conditions,” Jain said. However, Ajay Jain, chairman and managing director at investment advisory Monal Capital, believes that a lot of US funds are still chasing Indian properties. All of these items are far more essential to the big picture of successful actual property investing.

Using the lender’s loan-to-value , the appraised value is used to determine what loan amount the property can support. The owner can decide if refinancing is feasible or worthwhile once the estimated value is calculated. The estimated benefit of an investment divided by its cost is known as return on investment . Several factors influence your return on investment, including remodeling and maintenance expenditures, as well as the amount you borrowed to purchase your house. Due to its high-level measurement of an asset’s profitability, ROI is one of the most extensively utilized measures in commercial real estate.

Cap rate can be used to roughly estimate the return on investment of a real purchase or rental property.Here are the benefits of knowing the Cap Rate. Factoring in this collateral together with its fees, Blackstone needs to make a minimum annual return of 8.7% between now and 2028 to make money on the deal. This would be a slowdown for the fund, which has delivered 12.7% annually since it was set up six years ago. Its best bet for keeping this record on track is further rent growth in warehouses and residential housing.

A cap rate is a calculation used to determine the profitability of an actual estate funding. In essence, the cap price is the net working revenue of a property in relation to the property’s asset worth. The anticipated cash flow worth represents the net operating earnings and the asset worth matches with the present market value of the property. This results in the capitalization price being equal to the difference between the required rate of return and the anticipated progress price. That is, the cap fee is just the required price of return minus the growth rate.

Deductions From the Cap Rate

Different capitalization rates between different properties or different capitalization rates over different time horizons on the same property represent different levels of risk. A look at the formula shows that the value of the capitalization rate is higher for properties that generate higher net operating income and have a lower valuation, and vice versa. Net operating income is the annual income generated by the property and is determined by deducting all expenses spent on managing the property. These expenses include costs paid for the regular maintenance of the facility, as well as property taxes. The capitalization rate is the un leveraged return on an asset and reflects the relative risk of an asset.

It could be that some landlords need to sell real estate at less-than-ideal prices as refinancing becomes more expensive, but if this becomes a broad trend it will hit the whole market. However, US investors say its opportunities back home that are keeping them busy. “US investors are slightly hesitant in doing deals here as they are getting better returns in their home country. Private credit and private equity deals are happening but real estate deals are slow,” said a managing director of a US-based investment firm who did not want to be named. Experts additionally argue that areas the place properties match this ratio don’t even exist in one of the best places to invest in real estate.

All the commercial real estate you must know!

It is an important metric for real estate funds as it provides a snapshot of the fund’s overall value and helps investors to assess the fund’s performance. However, real estate investments have the advantage of doing well in a climate with rising interest rates. Before we reply what is an efficient cap price, we need to talk about what cap rate actually is. Cap rate, short for capitalization rate, is a return on funding measurement of rental properties no matter how they have been financed. The cap fee principally represents the estimated percent return an investor may make on an all-money purchase of the property.

What is 7.5% cap rate?

What does a 7.5 cap rate mean? A 7.5 cap rate means that you can expect a 7.5% annual gross income on the value of your property or investment. If your property's value is $150,000, a 7.5 cap rate will mean a yearly return of $11,250.

The general notion is that a higher cap rate project has higher risk and vice versa. However, it is upon the investor to decide as to the amount of risk he is ready to take over. Thus it can be stated that the choice of cap rates needs to be done after proper evaluation and selection of property based on individual preferences. The cap rate provides investors with a measure of risk and returns, helping them determine how much they will earn and how long it will take to recoup their investment. When considering refinancing, the cap rate can be used to determine property value.

Blackstone’s leaky property fund pays for a thumbs up

The price Blackstone is putting on the fund’s real estate, roughly half of which is housing, has come under scrutiny. As interest rates rise, a gap is opening up between the valuations used by private landlords and the sharper property-price falls implied by the shares of listed real-estate investment trusts. 3.Occupancy rate is the percentage of a real estate property or portfolio’s units or square footage that are currently leased or occupied by tenants.

- And virtually, this means buyers and property homeowners there are willing to just accept decrease-earnings returns due to the lower perceived risk.

- In terms of cap charges, this implies San Francisco haslowcap charges (i.e. excessive prices).

- If a property’s internet working earnings rises whereas its market value stays the identical, its cap rate will rise.

- A take a look at the formulation indicates that the cap rate value will be greater for properties that generate larger net working earnings and have a lower valuation, and vice versa.

- Firstly, the year-end usually sees them take a break after ongoing deals are consummated.

Another would be the lid or stop-cork for a bottle or anything to seal something. However, one more meaning of cap is essential in this context and that is the limit or restriction that is applicable. It also means capitalization, i.e. the market cap of an entity is its total capitalization on the bourses at any given moment. An optimal cap rate which is not too high and not too low anywhere between 4-10% is a good cap rate. Not useful when any loans are taken on the property or when the property is currently under improvement. We identify the ideal location for each firm using our highly trained real estate agents and our methodical strategy.

It’s a key metric for real estate investors and fund managers as it indicates the demand for the property and the ability to generate rental income. A high occupancy rate generally indicates a healthy and profitable property, while a low occupancy rate can indicate weak demand or poor property management. The occupancy rate is an important factor to consider when evaluating the performance of a real estate fund. Simply put, the cap fee for rental property is the web working income of a property in relation to the property’s market worth. The capitalization rate is the ratio of internet operating revenue to property asset value. The two % distinction between the construct to cap and the market cap makes this deal seem like a “go” deal.

The cap rate is an essential financial indicator in the real estate industry because it makes it easy for investors to figure out how much money they could make from an investment. However the property market fares in 2023, a fresh chunk of cash means Blackstone won’t be under pressure to sell. Having to accept discounts on its own real estate would make it tough to justify BREIT’s current valuation. While the University of California hasn’t given as fulsome an endorsement as the fund’s bosses might like, it is still a good result for Blackstone. If that is so, BREIT will have to explain how it thinks other property owners will be forced to offer bargains without an impact on its own valuations.

There are no clear ranges for a good or bad cap rate, and they largely depend on the context of the property and the market. In another version, the figure is computed based on the original capital cost or the acquisition cost of a property. The expense ratio should also be examined closely when assessing whether or not a multifamily property is worth its asking price. Generally, you want the end result to reach around 5 to 6 percent for a good return on investment. When the investor has an option to choose between these two options, apartment B is more beneficial. The rate of return is higher for apartment B, which will allow the investor to earn more profits than apartment A.

”—Real Estate investments are expensive, and it is only natural that you are concerned about the return on investment.Here’s why you need to know about the concept of the Capitalisation rate. For example, if an investment property costs $1 million dollars and it generates $75,000 of NOI a year, then it’s a 7.5 percent CAP rate. Remember how we said cap fee may be calculated for both a person property and for a complete market? Well, here it is determined by how rapidly you wish to start producing cash flow.

Once the estimated value is calculated, the owner can determine whether refinancing is possible or even useful. Is it a good decision to buy back your Treasuries and invest in an office building with an acquisition cap of 5%? An additional return on investment of 2% may or may not be worth the additional risk inherent in the property. Perhaps you are able to secure favorable financing terms, and with this leverage, you can increase your return from 5% to 8%. On the other hand, you may want the security provided by Treasuries, and a 3% yield is adequate compensation in exchange for that downside protection. As noted above, capitalization rates and price-earnings multipliers are inversely related.

Is cap rate the same as ROI?

Cap rate and ROI are not the same. The cap rate is the expected return based on the property value, but the ROI is the return on your cash investment, not the market value.