Contents:

We will use the adjusted values with the following code. Earlier, we saw the process of finding the ADX indicator using a simple table. Now, to work on real-world data, we would take the help of Python to make life easier.

Wilder suggests that a strong trend is present when ADX is above 25 and no trend is present when ADX is below 20. As noted above, chartists may need to adjust the settings to increase sensitivity and signals. ADX also has a fair amount of lag because of all the smoothing techniques.

In addition, it shows when price has broken out of a range with sufficient strength to use trend-trading strategies. ADX also alerts the trader to changes in trend momentum, so risk management can be addressed. If you want the trend to be your friend, you’d better not let ADX become a stranger. ADX has some weaknesses that make it unsuitable to be used as a standalone indicator. To start with, it is based on moving averages, which means that it is largely a lagging indicator that reacts slower to price changes in the market.

These crossover signals will be similar to those generated using momentum oscillators. Therefore, chartists need to look elsewhere for confirmation help. Volume-based indicators, basic trend analysis and chart patterns can help distinguish strong crossover signals from weak crossover signals.

We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy. Any time the trend changes character, it is time to assess and/or manage risk. Divergence can lead to trend continuation, consolidation, correction or reversal . When ADX is above 25 and falling, the trend is less strong.

Sir, pls send me all the excel for investment horizon of short term as well as long term and of course intraday too. ADX is normally plotted as a single line in a stock chart. Normally if -DI climbs above +DI, a sell signal is generated. The chart reflects the values of +DI, -DI, and ADX over the course of the time interval. Yarilet Perez is an experienced multimedia journalist and fact-checker with a Master of Science in Journalism. She has worked in multiple cities covering breaking news, politics, education, and more.

The traditional interpretation is that high ADX readings ensure that it’s likely for the market to continue in the direction of the prevailing trend. The ADX reading is an average of the absolute difference between these two values, which is the reason why it only shows the strength of the trend, and not its direction. When the negative DMI reads above the positive DMI, this means that prices are falling and this signals a downtrend. We provide Quality education related forex and indicators tool for your mt4.My all indicators system and robot Give you good trend in daily or weekly charts.

ADX Trading Strategy

The smoothing formula subtracts 1/14th of yesterday’s TR14 from yesterday’s TR14 and then adds today’s TR value. The truncating function is used to calculate the indicator as close as possible to the developer of the ADX’s original form of calculation . DMI assists in determining if a security is trending and attempts to measure the strength of the trend. If the ADX is rising then the market is showing a strengthening trend. Yes ADX can be used for commodity trading, but currently MCX exchange is not supported in the excel sheet. The DI+ and DI- line move away from each other when price volatility increases and converge toward each other when volatility decreases.

- But, as we mentioned above, we check the ADX indicator level as well to ascertain the strength of the trend.

- With high ADX-readings, some may react as described above, while others instead will benefit immensely.

- Parabolic SAR is a leading trend following indicator, and when combined with ADX, it could help traders to capture maximum returns in a trending market.

- ADX stands for Average Directional Movement Index and can be used to help measure the overall strength of a trend.

- ADX is non-directional and quantifies trend strength by rising in both uptrends and downtrends.

Wilder determined directional movement by comparing the difference between two consecutive lows with the difference between their respective highs. Designed by Welles Wilder for commodity daily charts, the ADX is now used in several markets by technical traders to judge the strength of a trend. The Moving Average Convergence Divergence indicator is used to determine trend direction, its strength as well as a possible reversal. When the MACD and ADX are combined, the former is best utilised to detect reversals, with the latter qualifying them. A signal to buy will be triggered when the MACD rises above the zero, line with the ADX rising above 20 and the +DI line crossing above –DI line.

Vortex Sniper Forex System (MT4 & MT

These three signals were pretty good, provided profits were taken and trailing stops were used. Wilder’s Parabolic SAR could have been used to set a trailing stop-loss. Notice that there was no sell signal between the March and July buy signals. This is because ADX was not above 20 when -DI crossed above +DI in late April. Above is a spreadsheet example with all the calculations involved.

We have come a long way today, from understanding the calculation of the ADX indicator as well as the python code to implement it, to the use of the indicator in your trading strategy. We have also understood that the ADX indicator is relatively simple to execute and helps us in identifying strong trends in the market. Although it has its own limitations, coupling it with other indicators will lead to a strong trading strategy. Used to measure the strength of a trend, ADX is one of the most versatile trading indicators out there. The positive directional index(DI+) shows the strength of positive price moves.

Grid Builder Indicator for MT4

In this instance, it would have been prudent to ignore a buy signal so close to this resistance zone. The average directional index has been found by technical analysts to be a very helpful indicator and has become one of the most frequently used technical analysis tools around. Using an ADX strategy to assess the performance of stocks allows traders to see when a particular share is overbought or oversold, according to the succession of lowering peaks.

Intuitively, if everyday new high is made compared to previous day high then we can say that the prices are moving up. In addition to the DI-crossover rule, ADX-14 must be higher than 25, signaling that there is enough momentum to make the market continue in the direction of the momentum. In this section of the guide, we’ll cover some of the most popular and common ADX trading strategies.

- And as is often the case in mean reversion, sudden and prolonged moves in one direction tend to result in a market reversal.

- ADX gives great strategy signals when combined with price.

- ADX values with 150 days or more of data will remain consistent.

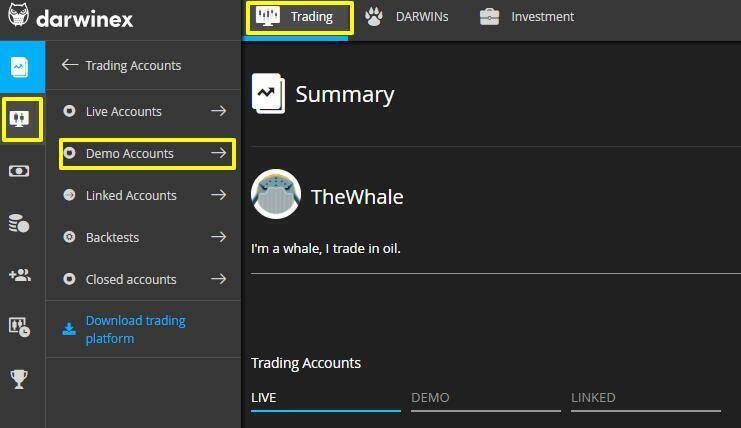

- SharpCharts users can plot these three directional movement indicators by selecting Average Directional Index from the indicator dropdown list.

- Because of Wilder’s smoothing techniques, it can take around 150 periods of data to get true ADX values.

It can be used to filter trades or generate trade signals. Cory Mitchell, CMT is the founder of TradeThatSwing.com. He has been a professional day and swing trader since 2005. Cory is an expert on stock, forex and futures price action trading strategies. The Average Directional Index, or ADX, is a trend indicator that is used to quantify the strength of a trend. It is plotted as a single line with a value between 0 and 100.

Step 1: Calculate the plus and Minus Directional Movement (+DM/-DM)

The sign of the adx value tells you which direction the market is trending. When trading forex, it is important to know whether the market is overbought or oversold. If it is oversold, then you should sell your assets; if it is overbought. The ADX Indicator actually works best when combined with other technical indicators.

Identifying Price Movement With RSI Indicator – Harlem World Magazine

Identifying Price Movement With RSI Indicator.

Posted: Mon, 29 Aug 2022 16:03:48 GMT [source]

Forex Pops Provide Free MT4 indicators and tools for help all beginners. We are just a few more steps away from the main point of this story, ie the ADX indicator. Here, we should note that the Smoothed negative DM was always 0, hence the Negative Directional Index Indicator will be 0. We would like to note that since the Negative DM was 0, the smoothed negative DM is also 0. If you’re not familiar with the RSI indicator, we recommend that you have a look at our complete guide to the RSI Indicator.

What is the ADX?

Smoothed versions of +DM and -DM are divided by a smoothed version of the Average True Range to reflect the true magnitude of the move. Using these three indicators together, chartists can determine both the direction and strength of the trend. But we see the data from Jan 2019 onwards, until May 2019, the price rose upwards with the ADX indicator above 25, signifying an uptrend and we can use this as a signal to go long.

Stocks with low volatility may not generate signals based on Wilder’s parameters. Chartists will likely need to adjust the indicator settings or the signal parameters according to the characteristics of the security. The two indicators are similar in that they both have lines representing positive and negative movement, which helps to identify trend direction. The Aroon reading/level also helps determine trend strength, as the ADX does.

Understand Vortex Indicator Trading Strategies – Investopedia

Understand Vortex Indicator Trading Strategies.

Posted: Wed, 26 Jan 2022 08:00:00 GMT [source]

Open an MT4 account now to practise your ADX strategy with virtual funds. You may wish to consider your execution strategy before placing a trade. When using the ADX indicator, it can provide us with information that is missing from a basic price chart.

Trend Following

Please let us know if you have any feedback or comments. ADX values below 20 may indicate neutral trend is present – oscillators are becoming more useful. According to Wilder, a trend is present when the ADX is above 25. In this case, the negative divergence led to a trend reversal.

The ADX indicator on TradingView does not display the +DI and -DI lines by itself, but you can use the Directional Movement Index indicator to see all three at the same time. A simple and effective strategy that is used by many traders is a crossover strategy that uses the ADX in combination with the +DMI and –DMI lines. In this trading strategy an order is placed whenever the +DMI and –DMI lines cross, as long as the ADX is also above 25, indicating a strong trend.

Random Walk Index (RWI) – Technical Analysis – Investopedia

Random Walk Index (RWI) – Technical Analysis.

Posted: Tue, 07 Nov 2017 19:38:26 GMT [source]

https://traderoom.info/ a common misperception that when ADX line starts falling this is a sign of trend reversal. Whereas, it only means that the trend strength is weakening. As long as ADX is above 25, it should be considered that a falling ADX line is simply less strong. Various market timing methods have been devised using ADX.

Readings between 50 and 100 represent increasingly strong trends. The chart shown below shows the average directional index indicating an increasingly strong uptrend as average directional index readings rise from below 10 to nearly 50. The Average Directional Movement Index was developed by famed technical analyst Welles Wilder as an indicator of trend strength. As a commodity trader, Wilder developed the indicator for trading commodity futures. However, it has since been widely applied by technical analysts to virtually every other tradeable investment, from stocks to forex to ETFs. It may lack predictive value in forecasting future price moves.

adx indicator formula can be used on any trading vehicle such as stocks, mutual funds, exchange-traded funds and futures. Commodity and historical index data provided by Pinnacle Data Corporation. Unless otherwise indicated, all data is delayed by 15 minutes. The information provided by StockCharts.com, Inc. is not investment advice. Trading and investing in financial markets involves risk. The calculation example below is based on a 14-period indicator setting, as recommended by Wilder.