Content

Unearned revenue is a liability since it refers to an amount the business owes customers—prepaid for undelivered products or services. In addition, it denotes an obligation to provide products or services within a specified period. You will only recognize unearned revenue once you deliver the product or service paid for in advance as per accrual accounting principles. It means you will recognize revenue on your revenue statement in the period you realize and earn it, not necessarily when you received it. Companies are turning to smarter, AI-oriented solutions for recognizing and reporting revenue, such as ProfitWell Recognized.

- The rationale behind this is that despite the company receiving payment from a customer, it still owes the delivery of a product or service.

- However, it is regarded as a prepayment for goods and services that will be conveyed at a future date.

- This kind of prepayment is an asset to the buyer (the person that pays) which is known as prepaid expenses but to the seller, who receives this payment, it is a liability known as unearned revenue or deferred revenue.

At this point, the company’s balance sheet would carry $800 worth of unearned revenue in the revenue of $400. Because $1,000 was paid and work will be done evenly throughout each month, the business would record a $200 debit to unearned revenue in each of the next five months. So, journal entries include not only an entry reflecting the total amount of unearned revenue but individual entries that break down the amount provided each month. Another typical unearned revenue example would be a service contract that has been paid for in advance. Take, for instance, a contractor who received $100,000 for a project, to be executed over ten months. This amount of $100,000 paid to the contractor is an example of unearned revenue because the contractor is yet to complete the job.

Unearned Rent Revenue is: a. a contra account to Rent Revenue. b. a revenue account. c. reported…

Unearned revenue is the income received by an individual or an organization for a product or service that is yet to be delivered. It is documented as a liability on the balance sheet as it represents a debt or outstanding balance that is owed to the customer. Once the $1200 has been received, the company enters this amount as a credit to unearned revenue. After four months, the company can recognize 33% of unearned revenue in the books, equal to $400.

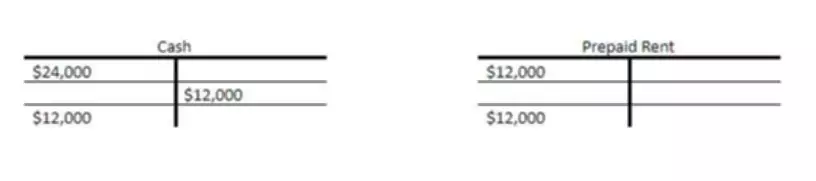

However, it puts a consumer at a disadvantage since it represents services or goods that have yet to be provided. A typical unearned revenue example to explain this would be professional fees of $12,000 that was received for six months. In order to calculate the unearned revenue that will be earned for a month, the $12,000 unearned revenue is divided by the 6 months, which will give us $2,000. A common scenario that many technology startups have is when they have a platform that is sold to the customer for a monthly fee. An example of unearned revenue in this scenario would be if a customer were to purchase a full year of access to the company’s tech stack for $1200/year. In order to get this deal, the customer is required to pay the company in full on the spot.

Business Operations

You record prepaid revenue as soon as you receive it in your company’s balance sheet but as a liability. Therefore, you will debit the cash entry and credit unearned revenue under current liabilities. After you provide the products or services, you will adjust the journal entry once you recognize the money. Unearned https://www.bookstime.com/articles/double-declining-balance-method revenue is the advance payment received by the firm for goods or services that have yet to be delivered. In other words, it comprises the amount received for the goods delivery that will take place at a future date.read more is where the money is received, but the goods and services are yet to be delivered.

- The balance of the unearned revenue account will then be reduced with a debit entry and then the balance in the revenue account will be increased with a credit entry.

- In accounting, unearned revenue is not treated as an asset or revenue as some would think.

- The unearned revenue concept is common in industries where payments are received in advance.

- Rather it is treated as a liability to the seller because it is the money that has been paid to the business in advance before it actually delivers the goods or services to the customer.

- Therefore, businesses that accept prepayments or upfront cash before delivering products or services to customers have unearned revenue.

- The first journal entry would reflect that $1,000 was paid, forming the company’s $1,000 worth of debit, or the total amount of money paid to the business but not yet earned.

Instead, they are recorded as an asset on the balance sheet until the expenses are incurred. As the expenses are incurred the asset is decreased and the expense is recorded on the income statement. Since deferred revenues are not considered revenue until they are earned, they are not reported on the income statement. Examples is unearned revenue a current liability of unearned revenue are prepaid rent, prepaid insurance, annual subscriptions for a software license. Larry’s Landscaping Inc. has provided landscaping services to its customer and satisfied its obligations. Larry’s Landscaping Inc. eliminates the unearned revenue liability and recognizes the $500,000 into revenue.