Contents:

By submitting this form I authorize Fincash.com to call/SMS/email me about its products and I accept the terms of Privacy Policy and Terms & Conditions. During the year a machine costing Rs. 40,000 with its accumulated depreciation of Rs. 24,000 was sold for Rs. 20,000. Cash payments to an insurance enterprise for premiums and claims, annuities, and other policy benefits. Cash receipts from royalties, fees, commissions and other revenue.

The given tool or parameter is used for reporting the amount of cash that has been spent or generated from various activities related to investment during a particular period. Some of the common investing activities of an organization are known to include the sale of securities, sale of assets, investment in securities, purchase of physical assets, and so more. Cash flows from income taxes shall be separately disclosed and shall be classified as cash flows from operating activities unless they can be specifically identified with financing and investing activities. The operations section on the cash flow statement begins with recording net earnings, which are obtained from the net income field on thecompany’s income statement. After this, it lists non-cash items involving operational activities and convert them into cash items.

For example, to expand a firm, a company can invest in fixed assets such as property, plant, and equipment. While this indicates a short-term negative cash flow from investment operations, it will help the organisation produce cash flow in the long run. A corporation can invest capital in short-term marketable securities to enhance profits. In the cash flow statement, interest received on investments is reported as a cash inflow under the investing activities section.

Cash Payment for acquiring the shares and other investments. Shareholders and investors tend to compare the Cash Flow Statements of different companies as it helps them to reveal the quality of their earnings. Shows the financial position of an entity during a period of time. This section includes activities such as dividend payments, loan payoffs, stock issuances, and the repurchase of bonds.

Interest received on investment will be___________

Cash Flow from Financing Activities Financing activities are the activities which result in change in the size and composition of the owner’s capital and borrowings of the enterprise from other sources. Therefore, ensure these 5 things to read in a financial statement of a company. Gold is one of the most preferred traditional investments for Indians, and Akshaya Tritiya is a day when many people prefer to purchase gold for various purposes, such as investment, weddings, and other festive occasions. Here are different mediums through which you can invest in gold on this Akshaya Tritiya.

- Capital expenditure is another important line item under investment activities.

- This ratio measures the ability of a company to translate sales into cash.

- So, let’s understand about the importance of cash flow statement for the shareholders and investors.

- However, there are other factors that a corporate major has to bear in mind before they go on a spending spree.

- In any case, what is important is that the return on investment is greater than the cost of capital.

Investors and analysts can determine how much a firm spends on PPE by looking at the sources and utilisation of funds in the cash flow statement’s investing section. The cash flow statement shows the source of cash and helps you monitor incoming and outgoing money. Incoming cash for a business comes from operating activities, investing activities and financial activities. The statement also informs about cash outflows, expenses paid for business activities and investment at a given point in time. The information that you get from the cash flow statement is beneficial for the management to take informed decisions for regulating business operations.

Classifications in the statement of cash flows

One classic example of such an inorganic expansion was the acquisition of Sterling Drugs, a pharmaceutical company by Kodak, an imaging and photography company in 1987. The acquisition was a massive failure and eventually resulted in a big loss of value to the shareholders, ending up with sale of Sterling Drugs to the Sanofi Group and partly to SmithKline Beecham in 1993 and 1994. CAs, experts and businesses can get GST ready with Clear GST software & certification course.

Cash Flows Cash flows are inflows and outflows of cash and cash equivalent. It implies movement in and movement out of cash and cash equivalents. Receipt of cash from a non-cash item is termed as ‘cash inflow’, while cash payment in respect of such item is termed as ‘cash outflow’.

INVESTMENT ACTIVITIES

Investing activities also include any income arising from sale and purchase of investments in other companies such as rent received from leasing fixed assets. As per the AS-3, the major cash inflows and outflows from investing activities are enlisted below. Cash flows from investing activities highlight how much money was spent on non-current assets (also known as long-term assets) that will offer value in the future. Investment activity changes property, plant, and equipment , a major line item on the balance sheet.

The KG-D6 basin is India’s largest-ever discovered pool of natural gas. When Jamnagar’s what is investing activities slow down, the basin will replace RIL’s extraction and other downstream activities. Of these, anincome statementgives a bird’s-eye view of the expenses and revenues of an organisation over a given time.

- Capital flow from investment activities is significant because it demonstrates how a firm allocates cash over time.

- He also recommends that one must keep an eye on growing fixed asset accounts or “soft” asset accounts (eg. Other assets), which may show signs of aggressive capitalisation.

- By submitting this form I authorize Fincash.com to call/SMS/email me about its products and I accept the terms of Privacy Policy and Terms & Conditions.

- Just upload your form 16, claim your deductions and get your acknowledgment number online.

- However, no guarantees are made regarding correctness of data.

Shows the changes in the balance sheet, and helps in analysing the operating, investing and financing activities. Sometimes a company may experience negative cash flow due to heavy investment expenditure, but this is not always an indicator of poor performance, because it may be leading to high capital growth. Cash receipts from repayments of advances and loans made to third parties (excluding loans, etc. made by financial institutions in ordinary course of business which is operating cash flow).

What is negative cash flow?

Investing activities involve the purchase or sale of long-term assets. The purchase of a business car, selling a building, or acquiring marketable securities are all examples of this. These items are recorded in the investment section of the cash flow statement because they entail the long-term usage of capital. Investors consider the cash flow statement as a valuable measure of profitability and the long-term future outlook of an entity. It can help to evaluate whether the company has enough cash to pay its expenses.

The amount of interest received is added to the cash flows from investing activities to arrive at the net cash flow from investing activities. The cash flow statement refers to a financial statement that provides details about the amount of cash and cash equivalents of a business. It is a key report that highlights the changes in a company’s cash flow over a specified period of time.

Used for assessment of cash flow from various activities, viz operating, investing and financing activities. The Revised Accounting Standard-3 has made it mandatory for all listed companies to prepare and present a cash flow statement along with other financial statements on annual basis. If suppose, the operating cash flow ratio of an entity is less than 1.0, the entity is not generating enough money to pay off its short-term debt.

1 Understanding Cashflow Statement

Interest received on investments is a cash inflow that is generated from investing activities. This is because it represents the return on investment made by the company. Interest income is generated from investments such as bonds, debentures, fixed deposits, mutual funds, and other securities. Interest received on investment will be added to investing activities. This is because investing activities involve the acquisition and disposal of long-term assets and other investments. Interest received on investments is an inflow of cash and is therefore considered a cash flow from investing activities.

The net balance of cash moving in and out of a firm at a certain time is referred to as cash flow. The cash flow from investing can either be negative or positive. Positive cash flow shows that a corporation is bringing in more money than spending. Interest received on investment is a revenue receipt and added in investing activities while preparing cash flow statement. Cash Flow from Investing Activities As per AS-3, investing activities are the acquisition and disposal of the long-term assets and other investments, not included in cash equivalents. A negative cash flow doesn’t always imply that the company’s financial performance was bad.

Although a company’s investment operations may generate negative cash flow, this does not always imply hurting the firm. The company’s cash flow might be impacted by purchasing property, plant, and equipment, but these assets will help produce revenue growth in the long run. Cash flow from Investing Activities is an integral part of the cash flow statement of a company.

This section shows changes in cash outflow that result from capital expenditures such as purchase of new property, equipment and business vehicles, including investments in instruments such as stocks and bonds. The statement includes the cash flow from operating, investing and financing activities. Generally, all investors and shareholders of a company want to get cash out of their investment. Hence, information about a company’s receivables and payables is of key importance to the users of financial statements. For other entities– An accounting policy choice needs to be made.

INUVO, INC. MANAGEMENT’S DISCUSSION AND ANALYSIS OF … – Marketscreener.com

INUVO, INC. MANAGEMENT’S DISCUSSION AND ANALYSIS OF ….

Posted: Thu, 04 May 2023 20:44:23 GMT [source]

Therefore, expenditures such as advertising and promotional activities or research and development, especially in-house development expenditure, typical in case of pharma or technological companies warrant special attention. While the cash flow from investing activities is an indicator of how new cash or existing cash is employed to generate future profitability, it also includes the cash flow from sale of assets, sale of business units etc. One should note the strategic direction of the company as well as the implication of such divestitures on the value of the shareholders. Under the Companies Act, 2013, there are specific provisions regarding sale of assets and business units to related parties especially directors of the company. One must pay attention on whether the transactions have taken place at a fair price and that all necessary compliances are in place.

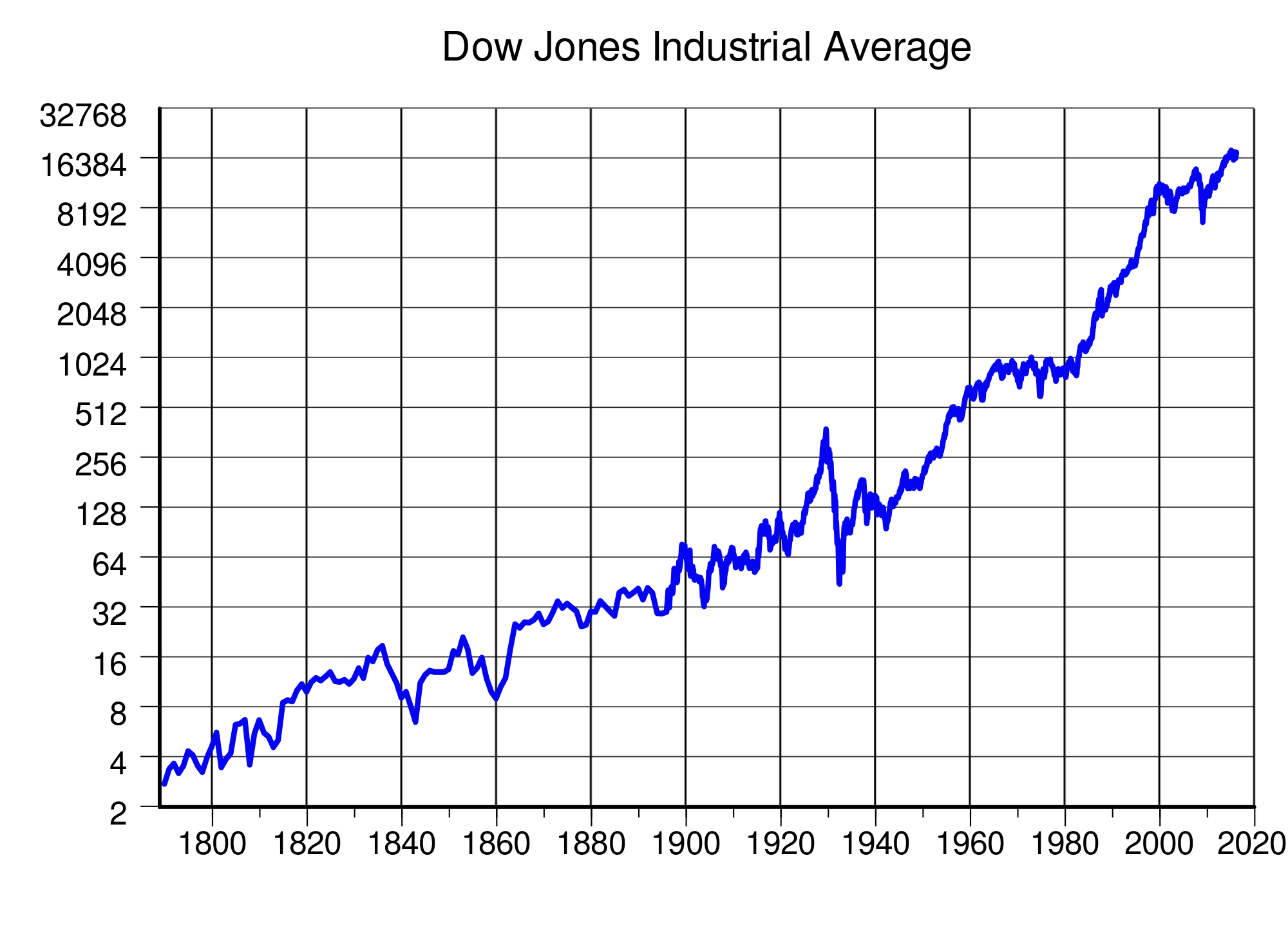

Enables investors to use the information about historic cash flows of a company for projections of future cash flows on which to base their investment decisions. Therefore, according to the accounting profession, Cash outflow to acquire fixed assets would be considered a cash-flow item from an « investing » activity. Any changes in the value of these long-term assets mean there will be investing items to display on the cash flow statement. All of these changes in the current assets and liabilities can be computed by comparing the composition of the balance sheet to that of the previous accounting period. Let’s see some frequent accounting transactions that show in the investing activities section of the cash flow. These examples will shed more light as it explained that is when a business buys or sells an investment, it is more likely that the activity will result in a profit or loss in the company’s cash flow.

What started eight months ago with investors asking for profitability, tighter control on costs and unit economics, to layoffs and downsizing, has now turned into a full static mode for the past few months. To add to this, a bunch of companies have seen major corporate governance lapses, highlighting how the excesses of previous years are throwing up concerns about basic business fundamentals. From the following information, calculate the cash flow from the financing activities. Selling off securities within a brief time bracket– positive cash flow.

DraftKings Reports First Quarter Revenue of $770 Million; Raises … – GlobeNewswire

DraftKings Reports First Quarter Revenue of $770 Million; Raises ….

Posted: Thu, 04 May 2023 20:15:00 GMT [source]

Assuming the company has some long-term debt obligations, a Cash Flow Statement helps the investors and shareholders to determine the possibility of repayment. It can be used to easily predict the timing, amounts, and uncertainty of future cash flows. Cash flow from operating activities- It is the section of a company’s cash flow statement that represents the amount of cash a company generates from carrying out its operating activities over a period of time.